Our Blog & Articles

Welcome to the Gordon & Associates CPA, P.A. Blog!

Explore expert insights on tax planning, accounting, and financial strategies tailored to help you succeed. Stay informed with the latest tips and advice to manage your finances with confidence.

Your financial peace of mind starts here!

Top 5 Tax Deductions Every Small Business Owner Should Know About

Maximizing tax deductions is essential for small business owners looking to reduce taxable income and increase savings. Key deductions include home office expenses, business vehicle costs, employee salaries...

The Role of Tax Planning in Building Long-Term Wealth

Effective tax planning is essential for wealth-building, helping individuals and businesses reduce taxable income, maximize deductions, and leverage tax-advantaged investments. Strategies like retirement contributions, estate planning, and tax-efficient...

The Role of a Business Consultant in Strategic Planning

A business consultant plays a pivotal role in strategic planning by offering expert insights, objective analysis, and actionable strategies. From conducting market research to setting achievable goals and...

Year-End Tax Planning Strategies to Reduce Your Tax Bill

Proactive year-end tax planning is key to reducing your tax liability and maximizing savings. Strategies like maximizing retirement contributions, leveraging bonus depreciation, harvesting capital losses, and donating to...

Why Tax Planning is Critical for Small Business Success

Tax planning is a vital tool for small business owners looking to reduce tax liabilities, improve cash flow, and drive long-term growth. Proactive planning helps minimize tax burdens,...

Unlock Hidden Tax Savings: How Cost Segregation Can Boost Your Cash Flow

Cost segregation is a powerful tax strategy that allows real estate investors and business owners to accelerate depreciation deductions, increase cash flow, and reduce tax liability. By reclassifying...

Understanding 1099 Forms and Your Obligations

1099 forms are essential for reporting non-employee income, such as payments to freelancers, interest, and dividends. Business owners must issue 1099s to qualifying recipients and file them with...

The Importance of Tax Preparation: A Guide for Individuals and Businesses

Tax preparation is more than just filing paperwork—it’s a vital part of your financial health. Proper tax preparation helps avoid costly mistakes, maximize deductions and credits, and ensure...

The Importance of Keeping Business and Personal Finances Separate

Mixing business and personal finances can lead to tax complications, legal risks, and financial disorganization. Keeping them separate ensures financial clarity, protects personal assets, simplifies tax preparation, and...

Retirement Planning for Small Business Owners: SEP IRAs, 401(k)s, and Other Retirement Options

Retirement planning is vital for small business owners seeking financial security beyond their business. Tax-advantaged options like SEP IRAs, Solo 401(k)s, SIMPLE IRAs, and Defined Benefit Plans offer...

What You Need to Know About Registering a Non-Profit Organization

Registering a non-profit organization is essential for gaining tax-exempt status, establishing credibility, and maximizing your impact. From filing Articles of Incorporation to applying for 501(c)(3) status, this process...

Top Tax Planning Tips for High-Income Earners

High-income earners face unique tax challenges, but with strategic planning, you can reduce your tax burden and grow your wealth. Maximize contributions to tax-deferred accounts, explore tax-efficient investments,...

The Legal and Tax Benefits of Registering Your Business

Registering your business offers more than just legitimacy—it provides vital legal protections and significant tax advantages. From personal liability protection to access to tax deductions, benefits like pass-through...

Tax Planning for Freelancers: Tips to Keep More of What You Earn

Freelancing offers freedom, but managing taxes is a key responsibility. From tracking income and claiming deductions to paying estimated taxes and saving for retirement, effective tax planning helps...

Why Year-Round Tax Planning is Essential

Tax planning isn’t just for year-end—it’s a year-round strategy to maximize deductions, avoid surprises, and stay compliant with changing tax laws. Whether contributing to retirement accounts or preparing...

Maximizing Your Tax Refund: Strategies for Individuals and Businesses

Unlock the full potential of your tax refund with strategic planning! From contributing to retirement accounts to leveraging tax credits and deductions, there are countless ways to reduce...

Unlock Hidden Savings: How the R&D Tax Credit Can Fuel Your Business Growth in 2025

Fuel your business growth with the R&D Tax Credit! This powerful incentive rewards businesses for innovation and improvement, offering dollar-for-dollar tax savings. From developing new products to optimizing...

Top Tips to Prepare for the 2025 Tax Season

Get ready for the 2025 tax season with confidence! Proper preparation can minimize stress, avoid errors, and maximize your refund or reduce your tax liability. From gathering essential...

The Importance of an Annual Report for Your Business

An annual report goes beyond summarizing financial performance—it’s a vital tool for transparency, trust, and strategic growth. From financial statements to future goals, it provides stakeholders with a...

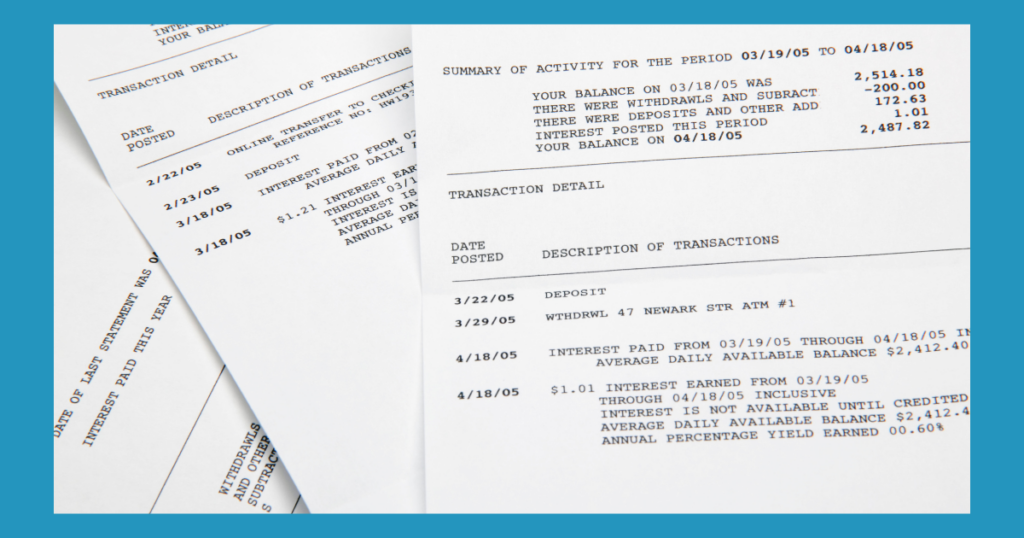

The Importance of Bank Statements for Individuals and Businesses

Bank statements are more than transaction records—they’re a vital tool for financial management. For individuals and businesses, reviewing bank statements helps track expenses, detect fraud, prepare for taxes,...

Mastering Budgeting: A Guide to Financial Freedom

Struggling to track where your money goes? You’re not alone—65% of people don’t follow a budget, leading to financial stress. Budgeting is the solution, offering clarity, debt reduction,...